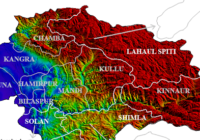

IT policy of Himachal Pradesh and its role in governance – HPAS Mains

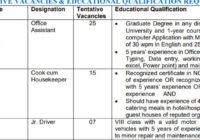

E-Governance– Electronic governance is defined as the application of information and communication technology for providing government services, exchange of information, transactions, integration of existing services and information portal. IT policy has been formulated in 2001 in Himachal Pradesh with a view to promote entrepreneurship, spread digital technology, improve social equity and justice through information technology… Read More »